With just a week to go until the General Election, we thought it would be worth touching on a few key elements.

2024 was already billed to be a record-breaking year for people going to the polls worldwide. With elections already held in India, Russia, South Africa, and across Europe and upcoming elections in Singapore, Pakistan, and of course, the US, there is a significant portion of the global population that will be asked to vote. On top of that, following the EU parliamentary elections earlier in the month, the French have now had a snap election called and the Belgian Prime Minister has also resigned.

So what? Do elections really matter to investment markets and your day-to-day finances?

It would be remiss of us to completely belittle a general election. At the end of the day, the elected government will dictate future changes in tax, legislation, and policy which will have an impact, either positively or negatively, on day-to-day life.

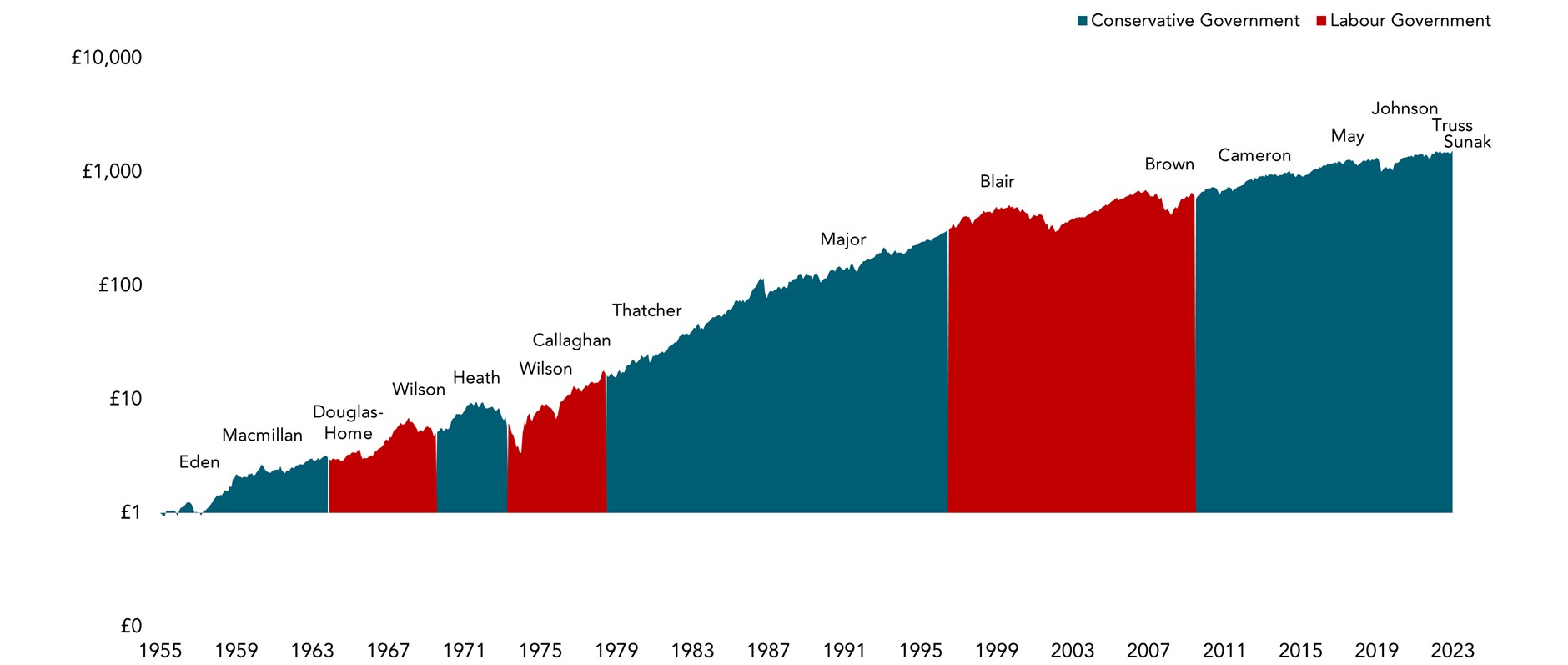

When it comes to elections, the one key thing to remember is that whoever is in charge on 5th July, history tells us that it will make very little difference to stockmarket performance. The chart below shows the growth of £1 in the UK stock market (not indicative of one particular investment) and as you can see, whether the blocks are red or blue, growth has continued.

The other key reminder, in times such as this, is that the UK economy makes up a very small percentage of the overall global investment market. In fact, the total value of the UK stock market makes up less than 4% of global markets. This means that if you are a medium-risk investor in, for example, a 60% equity-based portfolio, your total exposure to the UK equity market may well be less than 2.5% at any one time. So even if there was volatility, you would be unlikely to notice it to any great extent.

Chris and Mark’s principal roles are to see clients but this is only done successfully with the wonderful work that Lorraine and Karen do behind the scenes. There is a huge amount of effort that goes into the preparation of our meetings as well as ensuring that everything is actioned following a meeting and this would not be possible without Karen and Lorraine and the experience they both bring. Ciaran runs the operational side of the business in the background and Alastair continues to Chair our Investment Committee.

Whilst technology and online solutions are becoming more prominent in our industry, we firmly believe that there is no substitute for face-to-face advice delivered with compassion and care and we firmly believe this will lead to a better client outcome and experience.

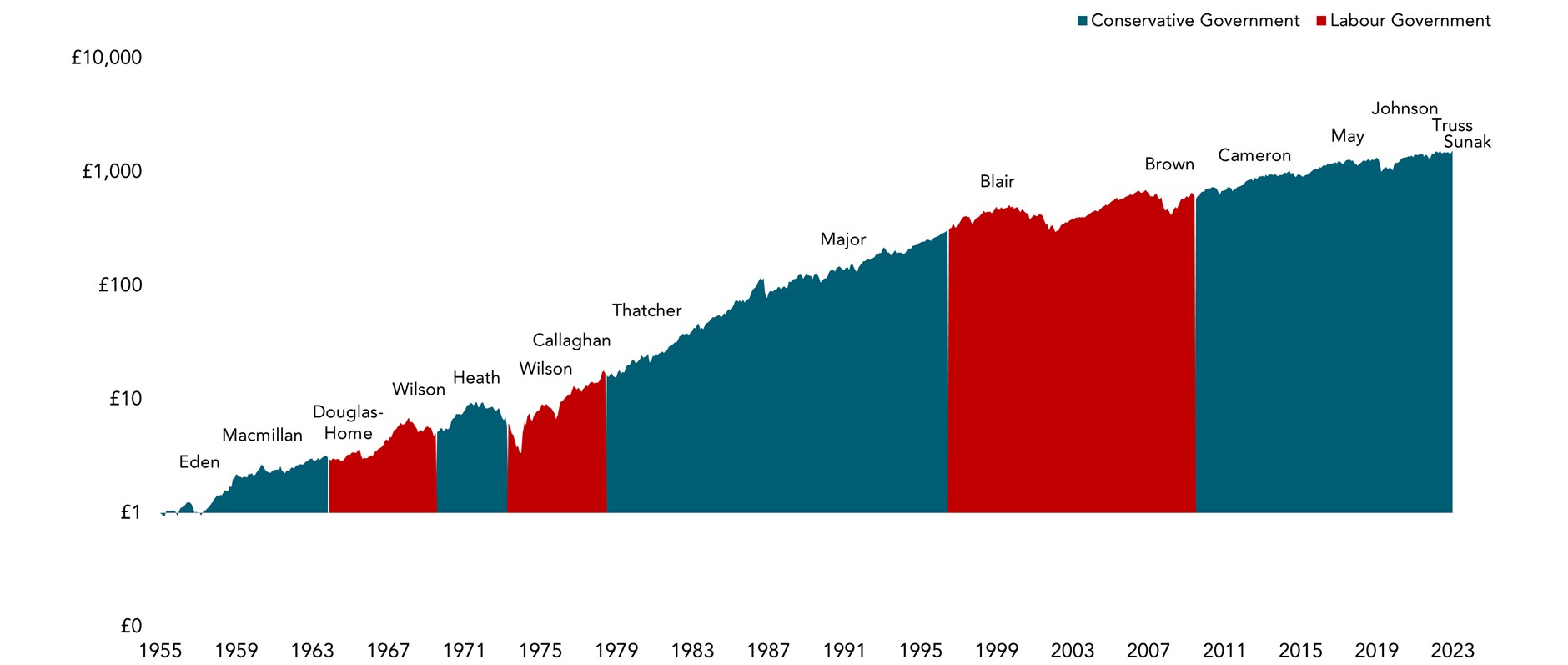

One election that is also on the horizon is the US election in November. The US stock market, in terms of value, is significantly larger than the UK. In fact, there are individual companies within the US stock market that have a greater market value than that of the UK. So in terms of elections that may have an impact on your investment portfolios, the US election is worth looking at. Again though, as the chart shows, whether it be a Republican President (red) or a Democrat (blue), the US stock market has continued to grow.

The moral of the story, if you are looking for one, is that elections will come and go, and whilst UK elections will have an impact, to an extent, on day-to-day life, long-term investment performance is not dictated by whichever party is in charge and the best outcomes are for those investors that are able to block out the noise and stay invested over the long term.

We considered ending the blog here but we are aware that some people would like to know a bit more about exactly how the election may affect things moving forward. Before continuing, please do not take any of the following as advice on who you should or shouldn’t vote for.

The devil is often in the detail when it comes to elections. The institute of fiscal studies has been critical of the amount of information being provided by the leading parties and stating that neither has actually detailed how they would square the tax and spending circle moving forward.

Currently, manifestos point towards spending on the NHS, infrastructure, and renewable energy, amongst others, but then also combining this with promises of no tax increases on Income, National Insurance, or VAT (albeit Labour will target non-doms and look to put VAT onto private school fees). With these core taxes making up c63% of the total tax taken in the UK, it could well be areas such as Capital Gains Tax, Inheritance Tax, or pension legislation that gets looked at to raise capital to fund their pledged spending.

Being three months into the current tax year, it would be almost impossible for a government to come in and immediately shake up any tax structures. Instead, the more likely outcome would be for the Autumn Statement to detail any plans that would then be implemented at the start of the 2025/2026 tax year.

We have had a significant number of clients who have asked about pension and tax legislation and the potential of this changing and whether it could be beneficial to hold off on further planning until we know the results next week. We don’t have a crystal ball but it would be extremely rare for current legislation to be altered resulting in people being penalised for making use of existing legislation.

For example, if there was a change in the amount anyone can contribute to a pension in any one tax year (Annual Allowance) this would likely be altered as above in the subsequent tax year. Similarly, even though Labour has taken it off the table for the time being, if the Lifetime Allowance on pension was re-introduced, there would more than likely be protections in place for those that have made use of current rules. As a result, we don’t see any reason to hold off on planning and making the most of existing legislation.

We hope this has provided some clarity but, in summary, if either one of the major parties is in power come the end of next week, there will still be questions to be answered as to how they will look to raise capital moving forward. As your financial planners, we constantly keep on eye on developments and the long term plans that we build can always be adapted to make use of a changing political landscape.

The key thing to remember is that history has repeatedly shown us that investment markets are incredibly resilient and we see no reason to do anything other than watch with interest as votes are counted next week.

Footnotes

* Charts from Dimensional Fund Advisors