This is a question that regularly comes up in conversation and one that is much more complex than it first appears. We could have written many variants of this blog depending on how you interpret this ‘simple’ question. We could have looked at ‘is now a good time to be invested?’ or ‘are markets about to rise and therefore should you be investing more money?’ but the problem with these questions is those that ask them tend to be thinking very short term.

Instead, we believe financial plans are long term and we should therefore look at the broader question, ‘does it make long-term financial sense to invest money?’. The short answer is yes, but why and how much?

How Much Should You Invest?

We would never advise a client to invest all of their available cash. The best time to invest is when you have money and the best time to sell is when you need it. Any further rationale would be an attempt to time the markets. We would suggest that if you are holding cash which you do not expect to require in the next 5 years, you should consider investing this, preferably in a globally diverse portfolio.

Cash

A quick look on a comparison site at the time of writing, would suggest that if you are willing to look hard enough, you can currently get interest of around 5% per annum for holding cash. This is the highest it has been in the UK since before the 2008 financial crisis so why not keep your surplus capital in cash?

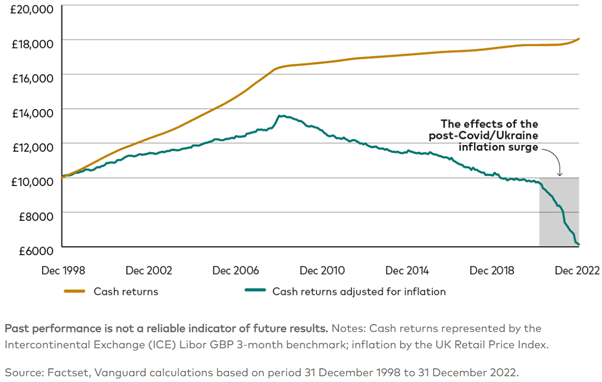

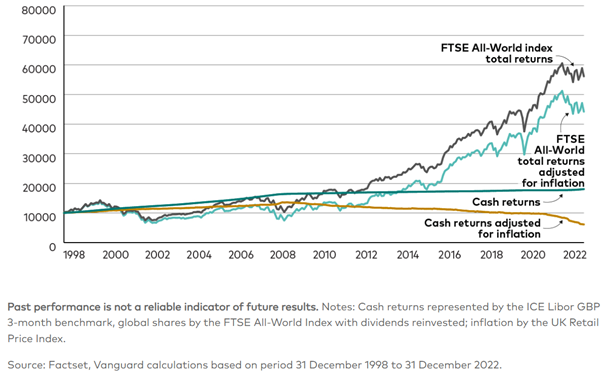

The core issue with cash is that it tends to be eroded by inflation over time. Vanguard (1) analysed holding £10,000 of cash from 31 Dec 1998 to 31 Dec 2022. Taking 3-month LIBOR (2) as an interest rate, your £10,000 would have grown to just over £18,000 by the end of the 24-year period. However, by adjusting for inflation (RPI), this same £10,000 would have been worth just over £6,000 at the end of the period. Even to the end of 2019, before COVID-19 and the subsequent rise in inflation, the same £10,000 would have, at best, merely held its value over a 21-year period.

Invest

Historically, the best inflationary hedge has consistently been Global Equities. Long-term data from many sources will demonstrate this but, for consistency, the £10,000 invested above over the same time period would be worth just £55,000 at the end of 2022 had it been invested in the FTSE All-World Index, or just over £45,000 once inflation has been factored in.

As with many things in life, the difference between cash and equities is the risk, the ‘equity-risk premium’ as it is often called. Holding equities is more risky than holding cash so investors should rewarded for taking this risk, and historically they have been.

Market Timing

One of the biggest dangers to an investment portfolio is attempting to time markets. This is holding onto cash until you think it is a good time to invest or sell because of the concern around a market fall.

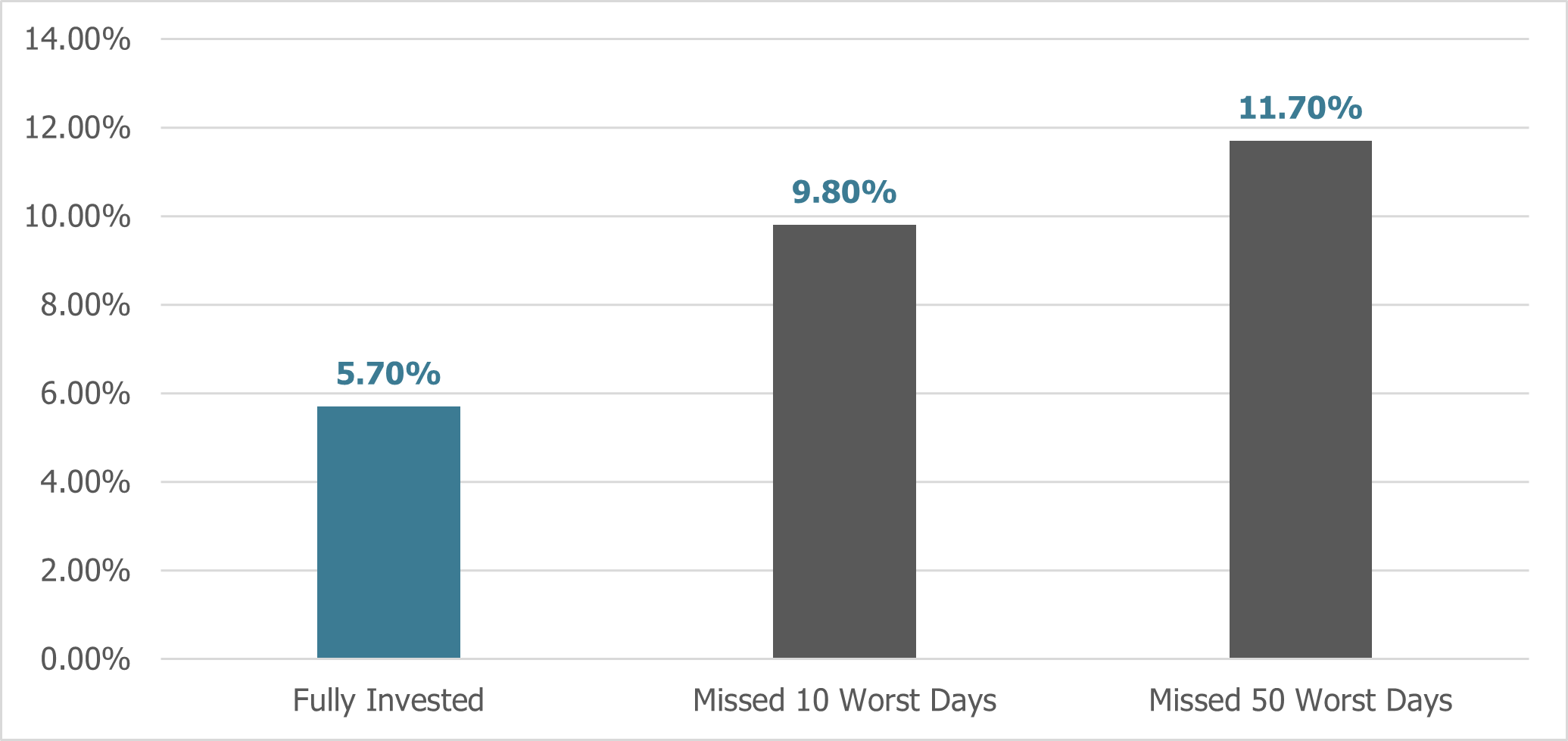

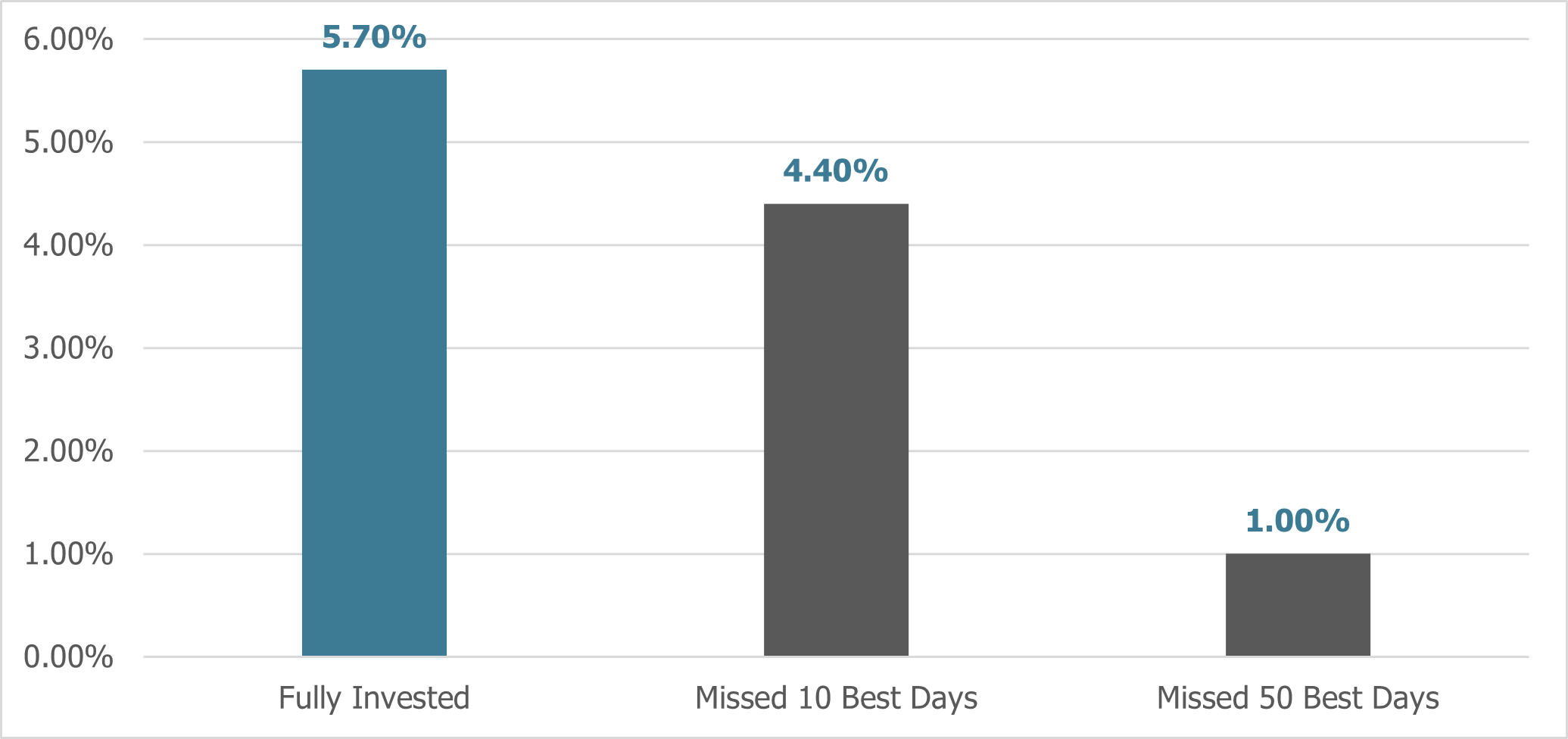

Tatton(3) has used Morningstar data to analyse the risk of trying to time the markets. In a balanced portfolio of 60% equities and 40% bonds, invested between October 2001 and October 2023, an investor could have seen an investment return of 5.7% per annum. A ‘lucky’ investor who managed to be out of the market for the 10 worst days during the period would have seen their returns increase to 7.6% per annum and an investor who managed to miss the worst 50 days, would have seen their performance more than double to 11.7% per annum.

If this same ‘lucky’ investor, instead missed the 10 best days, they would see their annualised performance drop to 4.4% per annum, or missing the best 50 days, their performance dropped to 1.0%, less than could have been achieved from cash.

Where this becomes even more interesting (for us anyway) is that the research shows that these best and worst days, more often than not, appear very close together. This explains part of the difficulty in trying to time markets. As Warren Buffet once said, “The stock market is a device for transferring money from the impatient to the patient”.

In Summary

- Cash tends to be eroded by inflation over time.

- Long-term, patient investors are rewarded.

- Global Equities have historically been the best hedge against inflation.

- Attempting to time the market is one of biggest dangers for an investor.

To go back to the original question, is now a good time to invest? For all the reasons noted above, we would suggest that it is as good a time as ever. There are plenty of known risks with investment markets and no doubt some unknown risks over the horizon, but we also know there are benefits to investing and these benefits should outweigh the risks over the long-term if history is anything to go by.

Footnotes

(2) London Interbank Offered Rate (LIBOR) is set by the major banks and used in the market as a rate for short-term loans.

(3) Tatton Investment Management – Don’t Time The Market Webinar – Nov 2023

The above article should not be treated as individual advice.