Hopefully, we don’t sound like a broken record with this, but once again, we find ourselves coming out of a couple of weeks of headlines about market crashes. We are conscious that the ‘tune out the noise’, ‘it’s not about timing the market but time in the market’ etc. etc. are so well trodden that many will be sick of hearing them.

With that in mind, we will summarise this blog very quickly, and then, for those still with us, we will back this up with more information.

Key Points

- Investment markets are volatile. They always have been. What has changed over the last 10 years is our access to 24-hour news.

- Even the largest markets in the world, such as the US, see considerable intra-year declines every year but more times than not, these recover.

- Evidence shows trying to time a market, is almost impossible.

24-Hour News

One of the best things about news these days is that it is 24 hours and accessible easily. One of the worst things about news these days is that it is 24 hours… this means that media corporations are forced to ensure that they have enough news stories to talk about on a rolling basis every second of every day.

This is certainly true when it comes to investment markets. A ‘crash’ is a great opportunity to tell viewers how many billions of dollars have been wiped off global markets in a single day. Funnily enough, we rarely hear of billions of dollars being added to global markets when markets rise as this doesn’t make good news.

When you add this to the fact there are considerably more ‘casual’ investors today than there were 20 years ago, this means that market volatilities are enhanced. If markets drop by 2% one day and the news starts reporting millions of dollars being wiped off markets, many inexperienced investors race to sell their investments for fear of a bigger decline. This adds further pressure to markets and we see what initially may have been a rational decline turning into an irrational, and sizeable decline.

American markets have been volatile for the last two weeks but if you jump on a news website, unless it is financially focused, you may not see any headlines about this, why? Well, it turns out that when there are other things to discuss, Trump tariffs, Russia/Ukraine ceasefires, Israel/Gaza conflicts, and a change to our welfare system, these market drops suddenly don’t seem like such big news!

Intra-Year Declines

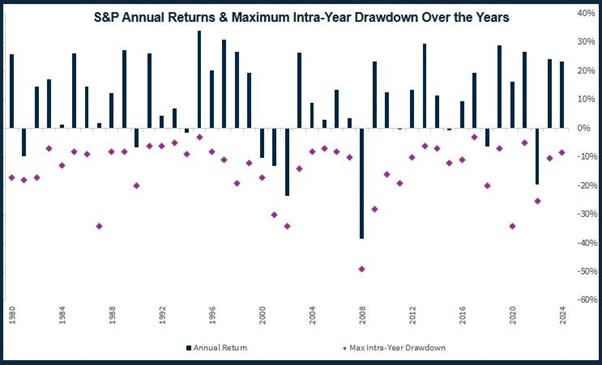

Rather than waffle on about intra-year declines, the easiest thing is to show you the following chart.

Looking back over the last 45 years, there has been a significant intra-year decline in the US Stock Market (S&P 500 in this case) every year but less than 1/5th of the time has that resulted in markets ending up at a loss so what we have experienced over the first few months of 2025 is no uncommon.

Beware of Market Timing

Finally, trying to time investment markets is almost impossible. Rather than regurgitate what has been said, we did a whole blog on when is best to invest and market timing. I would encourage you to read the below blog, but the summary is that by trying to time the markets to avoid the worst days, you risk missing out on the best days. Over 22 years, missing out on the 50 best days could see an annual performance of 5.70% reduced to just 1.00% per annum.

Blog – Is Now a Good Time to Invest?

For those who stuck with us after the ‘key points’, hopefully, this was a worthwhile read and remember that investing should be for the long-term. It’s ok to sometimes feel uncomfortable, but it should be with the knowledge that historically, markets have always recovered. The best analogy I have ever heard is likening market volatility to airplane turbulence. Everyone flies in the knowledge that they may experience turbulence, but no matter how much you anticipate it, it can still be very uncomfortable when it happens. Similarly, with investing, we do not invest for market volatilities but, instead we invest to meet goals and volatility is just an uncomfortable part of the journey.

Footnotes

None of the above should be treated as advice.